CURE is a short form of Citizens United Reciprocal Exchange. It was established in June 1990 by James J. Sheeran and Lena Chang, who were both former New Jersey Insurance Commissioners, according to the BBB (Better Business Bureau). CURE Auto Insurance offers a variety of auto insurance coverage in the states of Michigan, New Jersey and Pennsylvania. Although it is located outside of Princeton, CURE is not set up as a traditional insurance company in New Jersey, it is established as a non-profit mutual exchange organization.

Most of the auto insurance providers often expect high premium rates with low credit scores from drivers. CURE Auto Insurance is working to destroy that trend. CURE has a laudable goal, it may be a best choice for Michigan, New Jersey, and Pennsylvania drivers with poor credit. The company’s other aim is to provide accurate rates to nontraditional candidates but it falls short on the claims process, coverage selection, and customer service. Therefore, We recommend comparing auto insurance quotes from other top insurers as if you can find the best coverage with an affordable price.

Key Takeaways

- To offer premium rates at lower than average prices, CURE Auto Insurance has a good reputation.

- Auto insurance rates from CURE are solely based on driving-related factors, occupation or education level may not negatively affect premium rate.

- CURE may be a better choice for drivers with bad credit scores, but it is not best for high-risk driving records.

- It offers six standard types of coverage options for car insurance.

- It has a steady mix of positive and negative reviews of the CURE auto insurance.

- CURE Auto Insurance is only available in the state of Michigan, New Jersey, and Pennsylvania.

Here, we will present for you at CURE auto insurance review, coverage option, average cost, rate determine factors, discounts, compare cost with other top rated competitors and more that help you to make a good decision to choose the best coverage policy. In addition, We’ll explore the best car insurance companies in the insurance industry based on several factors like overall rank, financial strength, reputation, customer satisfaction, pricing, coverage, and other facilities.

CURE Auto Insurance Pros and Cons

| Pros | Cons |

|---|---|

| ✔Affordable rates with poor credit | ✖Only available in three states |

| ✔High customer satisfaction score | ✖Six standard coverage options |

| ✔Occupation and Educational level is not affect in premium | ✖No online claims filing |

| ✔Offers roadside assistance coverage | |

| ✔Fair rates to nontraditional candidates | |

| ✔ Available mobile app for Android and iOS |

Cure Auto Insurance Review and Ratings

CURE Auto Insurance was founded with a unique objective to provide favorable car insurance rates to drivers who may not be the most attractive to other insurance companies, customers with poor credit. If you have a job that requires frequent driving, but don’t own a home, or have a low credit score, these types of drivers may be less desirable to insurers.

To combat this, Cure primarily bases its premium costs on a motorist’s driving record at a relatively low rate, thus rewarding safe drivers at a reasonable rate, even if they don’t meet the conventional criteria for low insurance premiums.

CURE Auto Insurance Customer Reviews

CURE has mixed feedback on multiple online customer review platforms of auto insurance. It holds a rating of 3.5 (2024) out of a possible 5.0 stars from almost 3,182 responses on Google Reviews.

CURE Auto Insurance Reviews of BBB

CURE Auto Insurance has earned an “A-” (2024) rating from the BBB. It has 42 customer reviews on the average a rating of 1.0 out of 5.0 stars.

CURE Auto Insurance Review of J.D. Power

CURE is considered a small auto insurance company and only serves customers a variety of insurance products in three states. For this reason, CURE isn’t listed in any J.D. Power claims or customer satisfaction reviews.

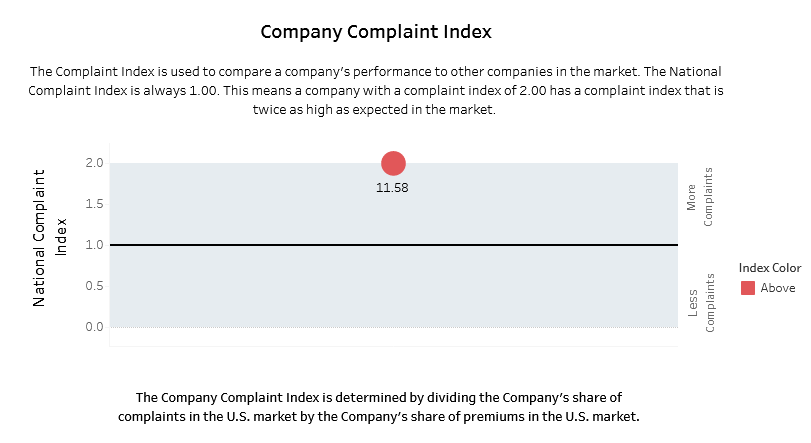

CURE Auto Insurance Review of NAIC Complaints

CURE auto insurance has a complaint index rating of 1.0 (2024), according to the National Association of Insurance Commissioners (NAIC). Which indicates that CURE received more than five times the average number of complaints than other agencies nationwide. Any number greater than 1.0 indicates that a company receives more complaints than expected for its size, while an index below 1.0 means the company receives fewer complaints than expected.

AM Best Financial Strength Rating

AM Best did not give a financial strength rating for CURE Auto Insurance. AM Best is a voluntary rating agency that takes money to have a company rated by them. Because CURE Auto Insurance meets all Office of Insurance Regulation standards set by the state, AM may choose not to participate in the Best Rating System.

CURE Auto Insurance App Review

CURE’s mobile app has relatively low reviews compared to other competitors’ apps. The mobile app has a 3.4 star rating on Google Play and a 2. 6 star rating on the App Store.

App accessibility

- View insurance ID card

- Get bill alerts

- Get your policy documents

- Make payment

- Review your coverage details

- Roadside Assistance

- Report a claim

- Request policy changes

- Contact customer service

- Check upcoming payment dates

CURE Auto Insurance Coverage Options

CURE car insurance offers basic and standard auto insurance options including personal injury protection (PIP), bodily injury liability, property damage liability, medical payments (MedPay), collision, comprehensive and Uninsured/underinsured motorist (UM/UIM). The company offers additional coverage endorsements, including rental car reimbursement and roadside assistance coverage option. However, CURE auto insurance policies are typically more basic than most insurers.

| Bodily injury liability (BIL) | It covers you against damages to other drivers that is organized by bodily injury liability. |

| Property damage liability (PIL) | The policy covers damages to other people’s property that’s made up of property damage liability. |

| Collision insurance | It covers the cost of damages to your vehicle if you collide with another auto vehicle or an object. |

| Comprehensive | A comprehensive policy covers you against any other damages to your vehicle that aren’t made due to a collision, such as: natural disasters, theft, vandalism, and civil disturbances etc. |

| Medical payments (MedPay) | This coverage covers the costs of yourself and your passengers for medical treatments both after an accident, whether who is at fault in the accident. |

| Personal injury protection (PIP) | It covers medical treatment and other injury-related losses, such as: lost wages from days you were unable to work. |

| Uninsured/underinsured motorist (UM/UIM) | This protects you in-case if you get into an accident with a motorist who is uninsured/underinsured and he consequently can’t cover your expenses. |

Cure Auto Insurance Add-Ons Coverage

Apart from basic and standard coverage, CURE Auto Insurance also offers a variety of optional add-on coverage options, just like other competitors, such as: roadside assistance, and customers can add extended transportation coverage for a fee.

| Roadside assistance coverage | CURE auto insurance policy comes with roadside assistance coverage, includes towing to the nearest repair facility, fuel deliveries, battery jump-starts, and lockout assistance. These services are limited to two claims per six months, and cover up to $125 per claim. |

| Extended transportation expense coverage | It is an add-on optional coverage that helps you arrange alternative transportation service when your car is in the Automotive service center for repairs after an accident. |

Factors of Determining CURE Auto Insurance Rates

It’s difficult to know exactly how much a CURE auto insurance coverage may cost, because several factors can affect your insurance rate, such as:

- Driver Age: If the driver is in their twenties or younger, CURE auto insurance will pay a higher than average premium rate for seniors. The CURE auto insurance premium rate will lessen after increasing your age like other insurers.

- Type of Vehicle: Luxury cars or newer vehicles can cost more to repair after an accident, and are more likely to be stolen, so these may cost more to insure.

- Where you live: If you live in a more populated area, your premium rates will likely be higher. Because, like another company, CURE may think you are more at risk of being involved in an accident.

- Driving record: If you have multiple speeding tickets or recent DUIs, you can count on most providers to charge higher rates.

- Chosen deductible: If your deductible is higher, the lower your premium.

- Recent claims history: If you’ve been in an at-fault accident within the last three to five years, your rate is more likely to be higher than average.

CURE Auto Insurance Cost

CURE auto insurance premium rates are determined based on several factors, such as the make and model, driver age, driving record, claims history, where you live and the amount of coverage you purchase, so the actual cost of your policy will differ for every driver. CURE’s auto insurance policies may be attractive to drivers with poor credit histories, as it does not use credit as a rating factor. This insurer also doesn’t consider education or occupation level in premium rate.

The US Pedia’s analysis team has collected average costs for CURE auto insurance coverages based on several different factors. The profile we researched was a 30-year-old male driver with a Ford F-150 car, a clean driving record and good credit score.

The research shows drivers do pay a national average of $1,968 annually for full-coverage. Generally, a car insurance full-coverage policy includes a sufficient amount of liability, comprehensive insurance and collision coverage.

CURE has a good reputation for boasting cheaper auto insurance rates for full-coverage, which means many policyholders may pay less than the below average rates.

The average full-coverage rates for CURE Auto Insurance:

| State | Average Monthly Cost | Average Annually Cost |

| Michigan | $282 | $3,384 |

| New Jersey | $198 | $2,380 |

| Pennsylvania | $284 | $3,402 |

CURE Auto Insurance Rate Comparison

Typically, CURE Auto Insurance quotes are more expensive than average cost across demographics. Based on these quotes Geico and Progressive for New Jersey drivers will likely be cheaper than CURE for most drivers.

| Company | Age 30 (Single male) | Age 35 (Married couple) | Age 65 (Married couple) |

| CURE | $1,026 | $1,252 | $1,171 |

| Geico | $716 | $507 | $489 |

| Progressive | $1,076 | $887 | $884 |

| Allstate | $1,398 | $1,704 | $1,014 |

Overall rating: 3.8 out of 5.0

Best choice for auto drivers with poor credit in Michigan, New Jersey, and Pennsylvania

CURE Auto Insurance Discounts

Although CURE is a back-to-basics auto insurance provider, it offers some of the competitive discounts. Before purchasing a CURE auto insurance policy, you must confirm whether these discounts are available in your state, where you live. And double check that you’re eligible for discounts.

Good driver discount: If your policy age is at least three years, and you haven’t an accident history, according to CURE’s online quote system, you may qualify for up to a 35 percent discount of your premium rate. It also adopts new policies, suggesting that all drivers of the policy must have a clean driving record for at least three years prior to the date of application.

- Multi-vehicle discount: If you insure multiple cars under one policy rather than having a separate policy for each car, you can qualify for a discount.

- Loss-free discount: If you are past a long time without making a claim, you will get a discount on your comprehensive and collision insurance coverage. Discounts range from 5% off after two full years with no claims to 20% off for five years.

- Parking discount: CURE auto insurance offers a discount for collision and comprehensive coverage policyholders who park in a garage or driveway rather than on the street.

- Good student: For students who maintain their high grades, CURE offers a discount on their auto insurance.

- Low mileage: If you only drive your car occasionally, you can qualify a discount with CURE auto insurance. It may save money for those drivers who do not drive daily.

- Defensive Driving Discount: In New Jersey and Pennsylvania, drivers can get a 5% discount on liability coverage, comprehensive, collision and personal injury protection (PIP) coverages by completing a CURE-approved defensive driving course.

Further discounts may be available by searching. We recommend contacting a CURE representative about discounts before signing up.

CURE Auto Insurance 24 Hour Customer Service

CURE representatives are available 24/7 for any service. After dialing 800-229-9151 to claims, without having to key in any prompts, you can automatically be connected with a claims representative. In addition, for customer service to speak to a representative for general CURE details questions, dial 800-535-2873:

If you’re a current or prospective customer:

- Michigan: Press 1

- New Jersey: Press 2

- Pennsylvania: Press 3

Methodology

We are researching CURE auto insurance coverage options, price, customer service, customer review and competitor coverage before preparing these reviews.

We are also analyzing a significant amount of data and information from state departments of insurance and QIS (Quadrant Information Services).

Average auto insurance cost for a driver in a specific area is determined based on selected inputs, such as: vehicle type, driving record, coverage amount and other information, and individual quotes are differentiated.

The average driver profile is based on the following person:

- 30-year-old male

- Clean driving record

- Collision and comprehensive coverage of 100/300/100 with a $1,000 deductible

- Ford F-150 car

- Annually driven miles 12K

Sample comprehensive and collision policies provide:

- $100,000 bodily injury liability coverage per person,

- $300,000 bodily injury liability coverage per accident, and

- $100,000 property damage liability coverage.

To calculate cost estimates for specific rating factors beyond the average driver, we modified the driver profile based on common pricing factors used by most car insurance companies. These factors include, but are not limited to, age, gender, place of residence, credit score, and driving record.

CURE Auto Insurance: FAQs

Is CURE auto insurance legit?

Yes, CURE Auto Insurance is a legitimate insurer in Michigan, New Jersey, and Pennsylvania that offers affordable coverage options for car drivers. It has a licensed number from the NAIC, which was issued by the State Department of Banking and Insurance.

Who owns CURE auto insurance?

CURE is a not-for-profit auto insurance company founded by James J. Sheeran and Lena Chang in June 1990. It offers affordable auto insurance coverage options in the state of Michigan, New Jersey, and Pennsylvania.

Is CURE auto insurance good?

CURE Auto Insurance ensures it doesn’t use credit scores, occupation, or educational background as determining factors for customer premium rates. This means consumers may find low premium rates with poor credit from this company. However, CURE Auto Insurance only sells insurance products in three states with limited discount options. Many drivers will likely find flexible coverage and a more affordable premium rate elsewhere.

Is CURE auto insurance in Michigan?

Yes, CURE Auto Insurance is available in Michigan for drivers with poor credit.

Does CURE Auto Insurance Cover SR-22?

CURE Auto Insurance doesn’t cover any SR-22 insurance certificates for high-risk drivers. Dairyland insurance is the best for SR-22 coverage.

Is CURE auto insurance cheap?

CURE Auto Insurance has a good reputation for offering premiums at cheaper than average rate. But it is not the best choice for high-risk drivers with bad credit scores. Major limit is CURE auto insurance is only available in Michigan, New Jersey, and Pennsylvania.

How do I make a car insurance claim with Cure Auto?

Dial 1-800-229-9151 number to make a claim with CURE Auto Insurance. This number is available 24/7.

Where is CURE auto insurance located?

CURE auto insurance located in 214 Carnegie Center, Suite 301, Princeton, New Jersey – 08540.

Daniel Jack is a senior finance and insurance writer and analyst at The US Pedia. For more than 8 years, he has been helping consumers learn about the finance, insurance and banking related. Daniel enjoys translating the complexities of insurance into easy-to-understand advice and tips to help consumers make the best choices for their needs. He completed his MBA (Master of Business Administration) from the University of Chicago.